Third-party data providers should submit accurate and complete information on time for individual filing season. This makes it easy for taxpayers to file tax returns and to stay compliant.Thank you for reading this post, don't forget to subscribe!

Employers who missed the EMP501 deadline on May 31, 2025, must submit as soon as possible to help employees meet their tax obligations. Late submission of EMP501s can lead to penalties.

Important Dates

Filing season for individual taxpayers (non-provisional) will run from July 21 to October 20, 2025.

Prepare to Submit Early

- Update all personal information, including contacts and banking details. This lets you receive timely SARS notifications and speed up the processing of any refund due. You can update your information easily online using the SARS MobiApp or eFiling.

- Have your eFiling username and password ready. If you’ve forgotten them, click “forgot username” or “forgot password” on eFiling to reset your login details.

- Collect all supporting documents for the 2025 period.

These documents include

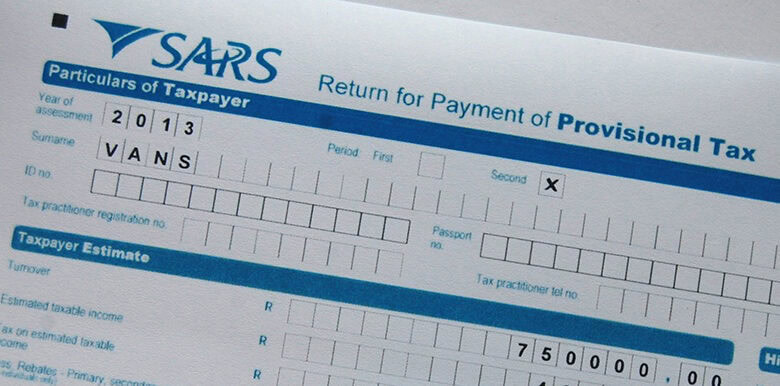

• IRP5/IT3(a) certificate from your employer

• Medical aid certificate

• Retirement annuity fund certificate

• Investment Income Statements (IT3b)

• Proof of donations

• Logbooks

Note: If both your cell number and email address used on eFiling have changed, you must book an appointment to visit a SARS branch.

New and Better eFiling Features

SARS has introduced a new Express Functionality on its eFiling platform to make it easier for taxpayers to comply with their tax obligations. Personal Income Tax returns are easily accessible on the eFiling landing page and directly usable.

When you log in to your eFiling profile, you will notice the new “Express” tabs at the top left of the home page.

These new functions let you:

• View your 2025 Auto Assessment.

• Submit previous years’ returns.

• Submit the current year’s return.

• Update your personal banking details

For more information on the new eFiling functions, please visit SARS’s YouTube channel.

Important Reminder

Not all individuals are required to file tax returns. Some individuals will receive an Auto Assessment, based on data collected from third parties.

• Auto Assessment notifications will go out by SMS or email to selected taxpayers from July 7 to 20, 2025.

• View your Auto Assessment notification on SARS MobiApp or eFiling.

• No notification? Check your Auto Assessment status by clicking on “My Auto Assessment Status.”

• Taxpayers who are Not Auto-Assessed or whose Auto Assessment was incorrect must submit their annual Income Tax Returns (ITR12) on SARS eFiling or MobiApp. These channels are convenient, letting you file wherever you are, 24/7.

No need to visit a SARS branch. If you must, first make a booking.

Beware of Tax Fraud

During Individual Filing Season, taxpayers can fall victim to tax fraud without knowing it. Tax fraud occurs when someone intentionally falsifies information on a tax return to reduce their tax liability or gain other benefits.

Safety Tips

• Never share your username, password, or OTP.

• All SARS services are free. SARS will never charge for its services.

• Ask SARS officials to identify themselves.

• Report suspicious activity if you suspect fraud: Report a tax crime.

At Caxton, we employ humans to generate daily fresh news, not AI intervention. Happy reading!